In last week’s post, we highlighted our 2022 expenses. This post will summarize our investments and process for funding our third year in early retirement together.

OUR INVESTMENTS

Our investment portfolio is roughly 70% stocks and 30% bonds/cash/REITs. As of December 2022, 56% of our portfolio is in taxable accounts that we can use at any time, 16% is in Roth retirement accounts, and 28% is in Traditional retirement accounts that are subject to RMDs at age 75.

Roth Conversions

Over the next several years, we will do Roth conversions to lower the amount that will be subject to RMDs. We will minimize the taxes on those conversions, making sure we pay no more than 10 or 12% tax rates (based on the current tax brackets). In 2022 we did our third year of Roth conversions, converting about 6% of the Traditional IRA balance. We kept our taxes in the 12% tax bracket and our dividends/capital gains at the 0% bracket.

Fees

We have some dividend stocks, but a majority of our investments are in mutual funds or ETFs. In the past I never paid much attention to the fees on the funds. As long as I was invested in funds with lower than category average expenses, and the funds were performing well, then all was good.

Over the past several years, I have been trying to streamline our investments and reduce mutual funds fees. At the end of 2016, the average fees on our mutual fund portfolio were 0.75% and at the end of 2022, the average fees on our portfolio were down to 0.12%.

We still have two mutual funds with high fees — both are in Dragon Gal’s 403(b) from her teaching job. At some point in 2023, we plan to roll that over to an IRA where we can hopefully find some much cheaper mutual funds.

We had a third fund with high fees that was in our taxable brokerage account and had a sizable amount of unrealized capital gains. Thanks to the down market and some tax loss harvesting we did, I was able to sell out of the rest of the fund in 2022 without having to pay any taxes.

Once we get out of the two remaining high fee funds, our average mutual fund cost will be only 0.04%.

CD Ladder

In the fall of 2019, we created a 5-year CD ladder, with enough money in each year to cover roughly 70-80% of our annual projected expenses. We were able to get CDs at rates of 2.05% to 2.40% (which seemed good at the time). We have had three CDs come due since building the ladder. Since rates were so low in 2020 and 2021, we did not renew into another 5 year CD. This past year we also didn’t renew into another CD because we didn’t want to have to sell any of our investments while the market was down. We will have to decide what to do in Q4 2023 when another CD comes due.

OUR EARLY RETIREMENT PLAN

I am a firm believer in over-analysis, and I have run numerous models and projections to analyze our financials and make sure everything will work. In Fall 2019, we put together an early retirement plan on how we would handle our finances after I left my job. We came up with the following key components of our plan:

-

- Each year we will live off of our investment dividends, interest, and small part-time jobs, and bridge the gap in expenses with capital gains from our investments or the cash from CDs.

- Build a 5 year CD ladder with cash.

- Let market performance dictate annual moves – If the market is up, we would sell investments; if the market is down we would use the cash from our CD ladder. We will also look at CD rates to determine if it makes sense to buy any new CDs.

- Pay ourselves every two weeks from our online savings account.

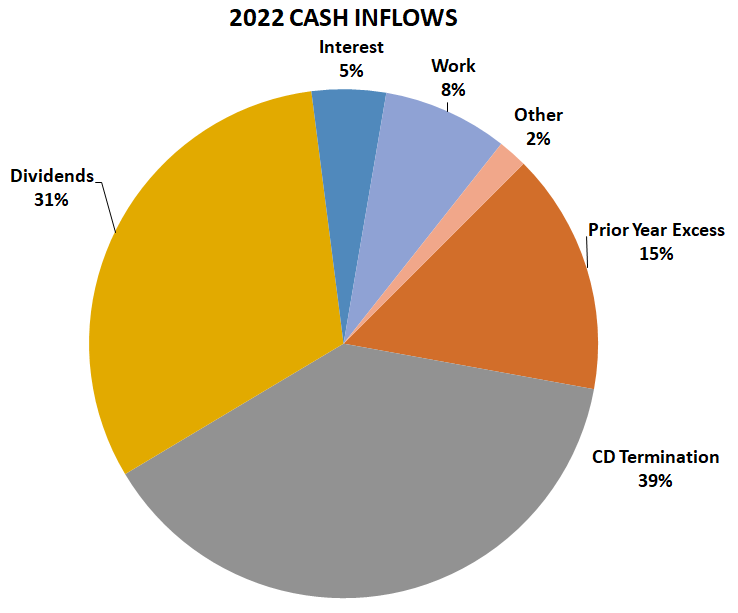

Based on our above plan, below is the summary of the inflows and outflows for 2022. On a net basis, our cash inflows were more than our cash outflows, so we did not have to sell any investments

|

|

INFLOWS

CD TERMINATION – 39% of CASH INFLOWS

When our third CD in our 5 year ladder came due in October 2022, we decided not to renew into another 5 year CD. Although the rates are higher than in prior years, we would have had to sell some of our investments to fund our expenses. With the market down in 2022, we did not want to do that.

This amount represents the principal from the CD; the interest paid out at the end of the CD term is in the interest category below.

DIVIDENDS – 31% of CASH INFLOWS

Our dividends come from our taxable investment account. We are mostly in index mutual funds or ETFs, plus a handful of dividend paying stocks. These funds and stocks pay dividends quarterly, including a large tranche in December. We take all of our dividends in cash and send them over to our online savings account, which is the source of our bi-weekly paycheck.

We have dividend paying funds in our retirement accounts, but I am not including them in our cash inflows, because we have no plans to touch these accounts until at least age 59.5. All of these retirement account dividends are reinvested.

PRIOR YEAR EXCESS – 15% of CASH INFLOWS

This amount represents the difference between cash inflows and outflows from 2021. Usually this is because we keep the cash from each CD that is expiring instead of rolling it into a new CD.

WORK – 8% of CASH INFLOWS

Dragon Gal did some contract teaching, and I did some contract work in 2022.

INTEREST INCOME – 5% of CASH INFLOWS

A majority of this interest comes from the CD that expired in our CD ladder. In addition, we also earn interest from our online savings accounts, 5% prepaid card savings accounts, and from bank account bonuses. In 2022, we earned over $1,500 in bank account bonuses.

OTHER – 2% of CASH INFLOWS

This includes cash gifts, money from cash back portals or apps, and the money earned from taking surveys with Prolific.

OUTFLOWS

EXPENSES – 65% of CASH OUTFLOWS

This is all of our 2022 expenses, excluding taxes and investment related items.

i-BONDS – 17% of CASH OUTFLOWS

We bought some more i-Bonds in Q1 2022.

INCOME TAXES – 7% OF CASH OUTFLOWS

In April we had to pay our 2021 income taxes, and we also started paying estimated taxes because we are doing more Roth Conversions.

HSA – 6% of CASH OUTFLOWS

We were both in HSA eligible health plans in 2022, and this is the contribution we made in January 2022.

RETIREMENT CONTRIBUTIONS – 5% of CASH OUTFLOWS

We made IRA contributions related to our 2021 earnings, and I made some 2022 contributions as well. We will make the rest of our 2022 contributions before we finalize our taxes.

GIFT CARDS

Another way we fund our early retirement is to buy discounted gift cards. In 2022, we purchased almost $10,000 in gift cards. We are often able to stack them with 5% cash back through our credit cards or cash back rebates via Mr Rebates or BeFrugal. We think of these gift card purchases as a mini-CD with high rates. We try to buy gift cards that at least give us a 5% return.

As the table below shows, we earned over 10% on our gift cards purchases. We’ve taken advantage of Chase and Amex offers that sometimes enable us to buy gift cards at 20-30% off.

FINAL THOUGHTS

Our early retirement plan continues to work for us. Although we spent more than we budgeted for in 2022, our cash inflows still enabled us to not have to sell any investments. This is a good feeling.

As we are a couple of years into early retirement, I feel less of a need to have as much cash on hand.

We bought i-Bonds in 2021 and again in early 2022. These i-Bonds will essentially act as our new CDs given their high rates. In addition, we are getting high returns from our discounted gift cards. Having all of these different forms of income and cash protection makes it easier to manage our early retirement expenses.

Leave a comment